How Much Money Should You Have Saved At 23

Savings past age

Minutes to read: 6 minutes

We all have our own dreams or things that nosotros want, no matter how erstwhile we are. Well-nigh of us need to salvage our money to make those dreams and goals a reality.

Fundamental accept-outs:

- Notice out how much Westpac customers accept saved at different ages

- Get some tips on getting your savings going.

While both these statements are true, it might exist good to know where we stand with our goals, dreams and savings compared to other people our ain age.

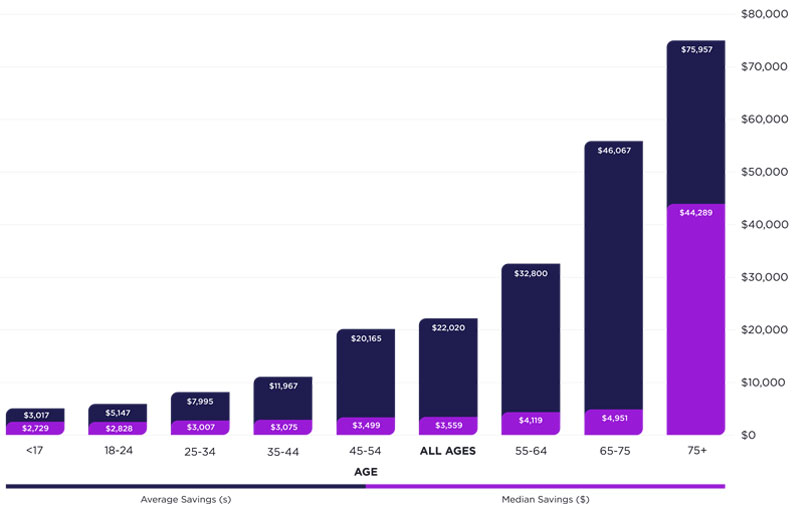

We have discovered that on average a Westpac group customer holds $22,020 in their transaction, savings and term deposit accounts as at the 31st Dec 20201. This effigy is skewed by some large deposit holders.

The more realistic figure is around $3,559 being the average for the median ring of between $500 and $20,000. This means 50% of our customers may take more $3,559 and 50% have less than this.

But what about your age grouping? As you lot can see in the below graph, as people grow older their average and median account balances increment.

Your business relationship balances may not expect the same equally this. You lot may be in a different fiscal position and may have very different dreams and goals.

All the same, no matter what your position, saving (fifty-fifty a pocket-size corporeality) will help y'all become what you want out of life and assist you to experience in command of your money.

We have taken inspiration from available data at Westpac to requite yous an idea of the wide savings goals for each historic period grouping. Both the Westpac Life and Crash-land accounts let yous to name up to six goals and tin can assist you lot determine how much y'all need to regularly save to achieve each of your goals past a certain date.

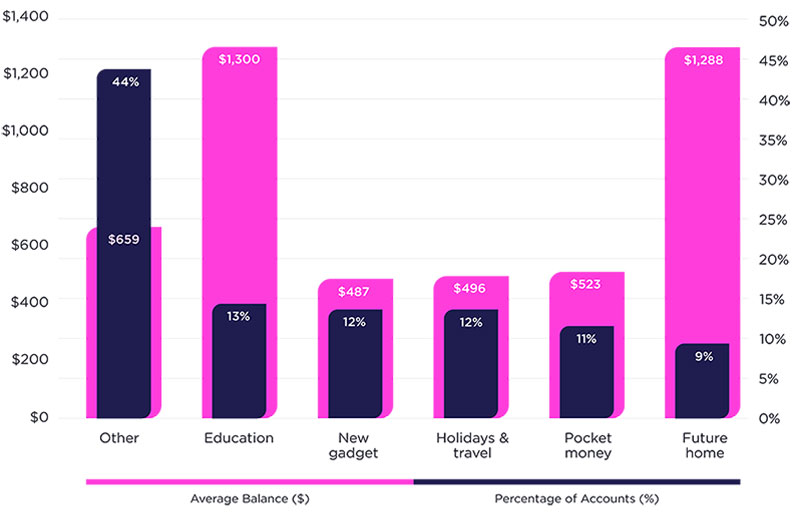

For nether 17's

Westpac Bump account holders (nether xviii's) typically create their own custom goals (labelled "Other" in the graphs). "Education" is the goal which account holders collectively have the nigh money saved towards, closely followed by "Future Home".

These are foundational years for building good money habits. Learn more than about money by doing a financial fettle class or visiting Westpac's "Get serious near saving" folio. You tin can also ready up your ain savings account and personalised goals here.

For xviii to 24 year one-time's

Custom labels ("Other") are still the most popular category for this group, followed by "Abode & property" then by "Holidays and travel".

13% of this age group are putting coin aside in a "Just in case" goal. While planning out our life and our goals gives us a meliorate adventure of achieving them, the universe sometimes has other ideas and will throw a curve brawl like the car breaking down or losing our job. Well-nigh advisors recommend a savings target of three to 6 months of your regular expenses. Learn more than virtually money by doing a financial fettle course or visiting Westpac's "Go serious near saving" page.

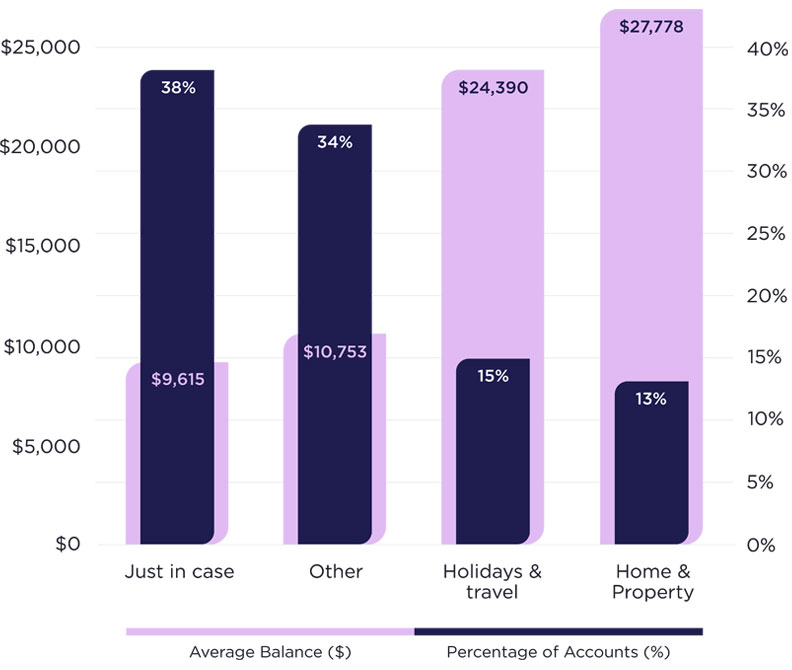

For 25 to 34 twelvemonth sometime's

"Home and property", while still second, has become more important with a greater proportion of people setting this goal and the average balances being higher. If buying a property is loftier on your listing, do your enquiry, talk to a abode finance broker or seek data from Westpac's Davidson Institute. To help you save a eolith visit Westpac's "Get serious about saving" page.

For 35 to 44 year old's

The custom label category ("Other") has grown a bit more in popularity which may reflect those who take got into the home they want and are now looking at other goals. However, many are all the same saving towards "Home & holding" possibly to buy their get-go home, renovate the dwelling house they have or maybe find a bigger dwelling house to accommodate their changing life and mayhap a bigger family unit. Whatever your life goals are at this phase, information technology pays to keep saving and learning. Refresh your knowledge and skills by undertaking a financial fitness course or visiting Westpac'southward "Get serious about saving" page.

For 45 to 54 year erstwhile's

The significant shift is that "Holidays and travel" has sprung into second place. For many, finances may go a scrap easier, and other goals such as overseas holidays or exploring locally might get front of mind. And when it is OK to travel overseas again, those who are saving will have the opportunity to do and then. If you are saving for travel, consider having a look at Westpac's "Travel & Holidays" page too every bit Westpac'due south "Get serious about saving" page.

For 55 to 64 twelvemonth old's

"Holidays and travel" remains the second well-nigh desirable goal, simply cautiousness appears to grow, as the "Just in case" goal has moved into third place for popularity. This may be a case of "older and wiser" having seen the amount of unplanned expenses life can throw at the states.

Depending on where you are at financially, you may get benefit from Westpac'south "Become serious about saving" page or be interested in Planning your finances for retirement.

For 65 to 80 twelvemonth sometime'southward.

Cautiousness prevails with "Just in case" becoming 2nd most popular goal. "Holidays and travel" drop a identify to third, although the boilerplate balance has grown compared to 55 to 64 year old'due south.

For over fourscore'south.

If you are over 80 that is fantastic, we hope your wellness and other life events are treating you well and you proceed to realise your fiscal dreams and goals.

While saving for "Only in case" has taken over first identify, "Holidays & travel" and "Dwelling and property" are still important.

What next

It does not matter what age you are, everybody has dreams and goals that may require saving for.

If you lot are behind the averages or medians, it may mean you have achieved your goals and spent the coin, which is fantastic. And think, it is never as well late to learn expert money habits and salvage for the things y'all want out of life.

Past setting your goals, separating your savings into a dissimilar account to your everyday spending and setting upward recurring payments, you may find chirapsia the averages easier than y'all remember. Have a look at some more than hints and tips on Westpac's "Get serious about saving" page.

Written by Westpac'south financial education specialists, the Davidson Institute.

1. All numbers are as at the 31st December 2020 and relate to Westpac group customers (Westpac, St George, Banking concern of Melbourne and Bank of South Australia), who are over eighteen, regularly deposit into an account and regularly transact and take a transaction account, savings account or Term deposit.

2. All numbers as at 30th September 2020 and relate to Westpac customers property a Westpac Life or Westpac Bump account.

Things y'all should know

This information is general in nature and has been prepared without taking your objectives, needs and overall financial state of affairs into business relationship. For this reason, you should consider the ceremoniousness or the information to your own circumstances and, if necessary, seek advisable professional advice.

© Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.

© St.George Bank - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.

© BankSA- A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.

© Bank of Melbourne - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.

Source: https://www.westpac.com.au/personal-banking/solutions/budgeting-and-savings/savings/savings-by-age/

Posted by: almanzarandee1939.blogspot.com

0 Response to "How Much Money Should You Have Saved At 23"

Post a Comment